The global geopolitical situation with the Eastern European crisis, coupled with the rollover of the Covid-19 pandemic, caused disruptions and has led to sustained high rates of inflation globally. The SSA region of Africa remains exposed to the effects of these risks with implications of low business growth and supply chain disruptions caused by scarcity and the rising cost of raw materials, commodities, energy, and transport.

Major central banks have resulted in hawkish monetary stances to combat persistent inflationary pressure, and several central banks have increased interest rates. Higher interest rates mean higher borrowing costs, which will eventually cause people to spend less, as their disposable income shrinks. The demand for goods and services will then drop, causing inflation to fall. Our primary concern is for lower-income countries with limited space for fiscal support due to ailing government revenues and expected increases in borrowing rates. Monetary policy normalisation could lead to narrowing spreads in interest rates, forcing SSA countries to respond and defend fund flows in 2022. This could be problematic for some SSA countries experiencing higher levels of fiscal imbalances on the back of fragile recovery. This leaves businesses at an immediate disadvantage without access to affordable financing options.

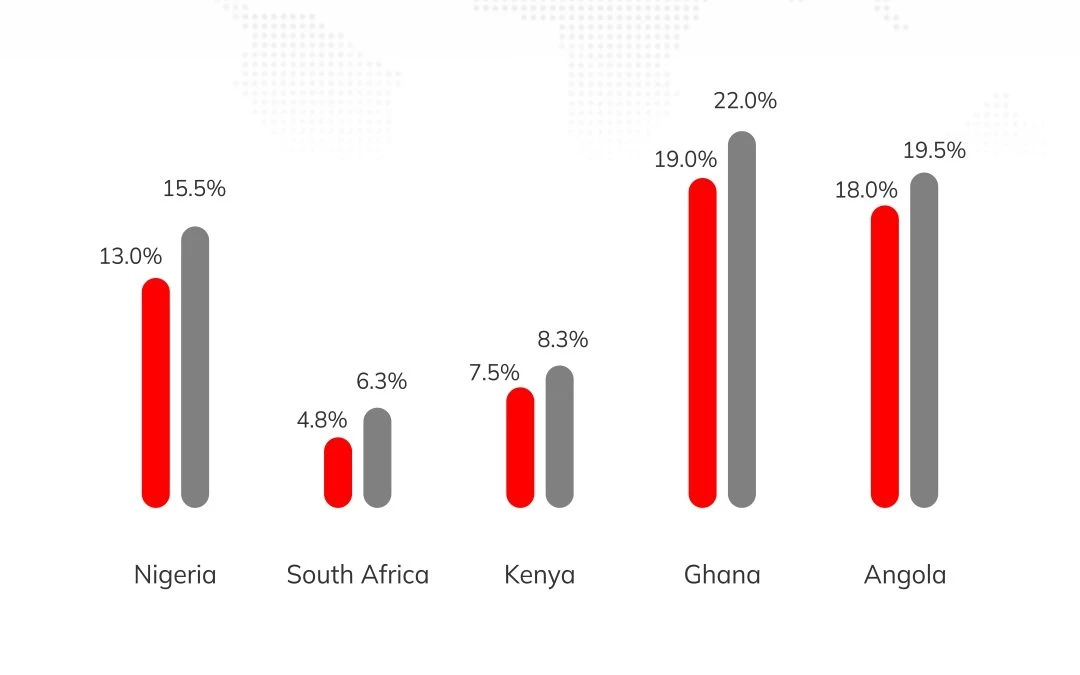

Monetary policy tightening has sharply increased borrowing costs:

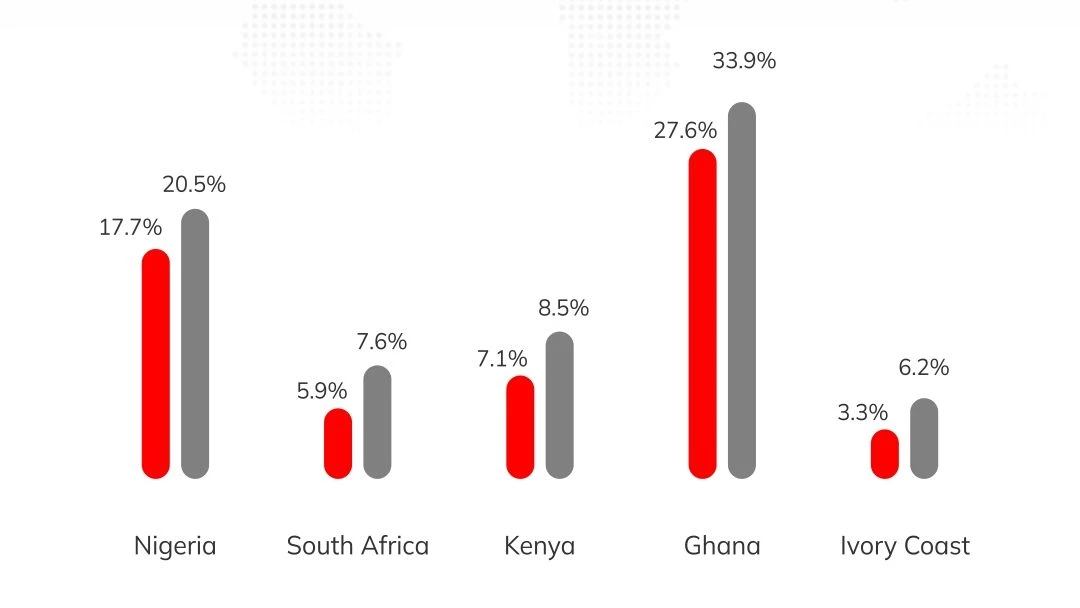

Inflationary pressures have remained abound across Sub-Sharan countries due to rising food and energy costs:

Africapitalism suggests a solution through long-term strategic investments, allowing the private sector to thrive as Africa’s key enabler of economic and social wealth creation. Also, the emergence of the Africa continental free trade agreement promotes bilateral currency exchanges, limiting African countries’ dependence on dollar trade.

Heirs Holdings is inspired by Africapitalism, the belief that the private sector is the key enabler of economic and social wealth creation in Africa. Driven by this philosophy, Heirs Holdings invests for the long-term, bringing strategic capital, sector expertise, a track record of business success and operational excellence to companies we invest in.