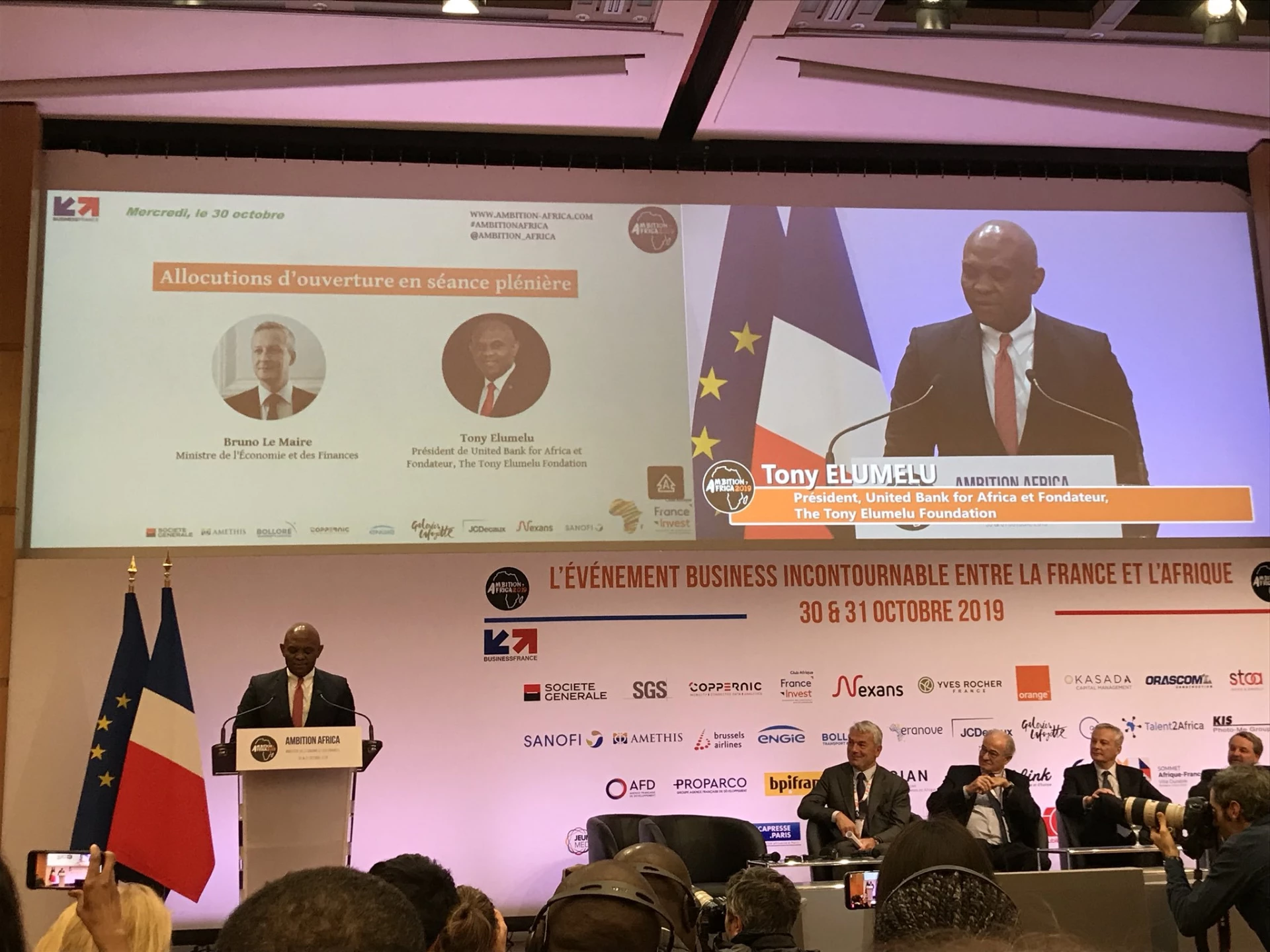

The Keynote address at the Invest for Growth in Africa Conference French Ministry of Finance and Economy Paris, France

- Good afternoon all;

- Monsieur Lemaire, French Minister for Economy and Finance

- Monsieur Gillard, The Chairman of France Invest and the organisers of this event

- Monsieur Schricke, Chairman, France Invest’s Africa Club

- Members of the France Invest gathered here today

- And other distinguished members of the audience present here today

- My name is Tony Elumelu, Chairman of United Bank for Africa, Africa’s global bank, present in 20 African countries, the US, UK and here in France.

- I also chair Heirs Holdings, a family investment vehicle with interests in power, resources, healthcare, hospitality and real estate, and financial services.

- I created the Tony Elumelu Foundation, the leading African philanthropy, committed to empowering young African entrepreneurs – from all 54 countries on our continent – we are 5 years into a journey of catalysing young people, with seed capital, training and mentoring.

- Just to give you some idea of the depth of talent and drive in Africa, we are expecting applications for this year’s programme from over 400,000 people – last year we received about 300,000.

- I am delighted to be here to open the session of the Invest for Growth in Africa Conference, alongside the Minister for Economy and Finance.

- France has a long history of engagement and interest in Africa – we talk of Franc-Afrique. I witnessed last year a new chapter in that relationship – and perhaps an important turning point. I hosted your President, Emmanuel Macron – introducing him to 2,000 young African entrepreneurs – it was an electrifying experience. We touched on taboos and he listened with a refreshing frankness. It offered exciting prospects.

- It is important to salute the important work that France Invest does in ensuring the growth of start-ups, SMEs and mid-caps in France, illustrating that private equity can be a force for the positive development of companies and underlining the criticality of the SME sector in any economy.

- In Africa, we have to encourage the growth of SMEs – only they have the catalytic ability to create jobs and wealth in communities.

- Historically, our focus had been primarily on the creation of jobs and employment, through the public sector. This has to change.

- We know there is only so much that governments can achieve through direct job creation and it is the private sector’s responsibility and role to lead the way in the sustained creation of wealth – and the broader social benefits that flow from a vibrant private sector.

- In Africa, today, we have a large youth population, who are eager and innovative, they are looking at solutions to problems in their communities but are hampered by the access to capital and investment, and mentoring and training

- In our programme, we are acting forcefully to remedy this – but we can all do so much more.

- According to the IFC, private equity accounts for about $200 billion in investment worldwide each year. But only 10 percent of it reaches emerging markets – in Africa, despite the good intentions of the development finance institutions, this figure is even less.

- We need to do much better and be much smarter in channelling these funds to emerging markets, these markets present huge opportunities – as well as risk – for investors. We salute French companies, such as Total, Bouygues, Accor, Orange and Bolloré, who have accepted this challenge – but there is room for many more

- When done right, this kind of investment can bring not just capital but can also strengthen job creation, corporate governance and help improve sustainable business practices.

- In many of our economies, capital markets are either nascent or non-existent, small and medium-size enterprises lack access to debt finance and cannot secure critical financing through private equity.

- I see the potential of investing in African youth and businesses every day, through our Foundation, as we empower young Africans with the tools required to grow their ideas and nascent businesses; non-refundable seed capital, mentoring and training, access to the largest online platform for African entrepreneurs – TEF Connect – which connects them to other entrepreneurs on the continent for collaboration as well as access to investors for second-stage funding.

- Africans do not need aid – rather our young people need investment, and that is the message I bring to you all today.

- 60% of our population is below the age of 25, we have the youngest workforce in the world – and most mobile. This mobility can sometimes create tragedy as our young are driven across the Mediterranean.

- If channelled successfully, our youth population has the potential to create businesses that will contribute to economic growth but also create jobs for millions of other African youth – anchoring families, sustaining communities, creating sustainable growth.

- One sector stands out – power, today there is a significant power gap across the continent, this increases the cost of business and is often a reason why SMEs are unable to scale their enterprise.

- But power is an opportunity for an entrepreneur, it is a call to anyone with innovative solutions to the problem to reap the benefits of investing in this underdeveloped sector – from small off-grid networks, to hydroelectric, to green energy.

- Through our Group’s power company, Transcorp Power, we have invested in power and are today the leading power generating company in Nigeria, with an installed capacity of 900 Mega Watts and are currently closing the acquisition of another 1000 Mega Watts to double our capacity – but we are scratching the surface – because frankly we could quadruple supply – the demand is huge.

- We are interested in innovation and disruption – to light up schools, power hospitals and drive industry.

- When I say that there are opportunities in Africa, I mean it and I live it.

- I have a philosophy – Africapitalism – it champions a private sector led approach to the development of the continent through long term investments that create economic prosperity and social wealth we need to create both economic and social wealth!

- Key phrase here being long term investment – no one should come to Africa for short term gain.

- We are all aware of the skill and knowledge gap, we need people like you to come to the continent and fill this gap, in doing so, you will undoubtedly reap the benefits of doing so.

- I am fully aware of the challenges of doing business in Africa, we have long been plagued by bureaucracies – red tape- corruption and lack of infrastructure.

- But things are changing, the environment is getting better for business, my country, Nigeria has moved up many places in the World Bank ease of doing business report, in 2 consecutive years – a step in the right direction and I commend President Buhari’s administration for this success.

- Tax laws still need to be simplified, bureaucracy streamlined, and the rule of law firmly entrenched in our business practices across Africa to ensure that investors have confidence in the system and do not shy away from the continent.

- We must be prepared to take risks if we are to drive lasting benefits. The great industrialists of recent history, the Rockefellers, Vanderbilt’s the Rothschild’s the Peugeots and the Dassault’s recognised that risks must be taken for great rewards to be obtained.

- Let me finish by saying that the time is now to invest in Africa and African SMEs

- And private equity can play a huge part in this.

- By providing the critical financing as well as the strategic support missing, we can improve the outcomes of entrepreneurs on the continent as well as profitably invest in Africa.

- I keep in my memory – the image of your – young – President – someone who worked in Abuja our capital – surrounded by our youth – speaking I may say in English!

- He gets the need for change – in the relationship between France and Africa – a change to a relationship based on appreciation of shared values and powered by the opportunities that our demographic explosion offers.

Ladies and gentlemen, I look forward to welcoming you to Africa.

Thank you.

Tony O. Elumelu, CON

Chairman, United Bank for Africa

Chairman, Heirs Holdings

Founder, Tony Elumelu Foundation